|

<< Click to Display Table of Contents >> Managing Deposits |

|

|

<< Click to Display Table of Contents >> Managing Deposits |

|

Overview:

This document describes how to manage deposits within iTMS and MYOB. The user will need to contact iTMS to ensure their system is set-up correctly to utilise Pro-Forma Invoice. This process is used so that the value of the order does not change in iTMS and that the deposit amount goes through the correct accounts in MYOB for accurate accounting.

Create the ‘Client Order’ as normal and press <F9> to save. Re-open the ‘Client Order’ and click on the “Despatch” tab to open. In the ‘Proforma Invoice’ area, enter the date, deposit amount, and a deposit note in the appropriate fields.

Press <F9> to save. The Order must be saved and re-opened to enable the user print or email the proforma invoice with the deposit amount and note displayed.

In MYOB, open the Sales module and click on ‘Enter Sales’. Create an invoice for the deposit, and manually enter the Invoice number. Enter a description for the deposit and press <TAB> to move to the “Acct” column. Click on the drop-down arrow and ensure to select the “Deposits Collected” liability account which has an N-T tax code, click on the Use Account button.

A message appears – click OK.

Do not enter anything in the “Amount” column, enter the deposit amount in the “Paid Today” field, and select the payment method. Complete other fields as required and click the Record button. The Balance Due is recorded as a negative.

The iTMS Order is despatched, invoiced and exported to MYOB when the job/s are complete. Export as normal.

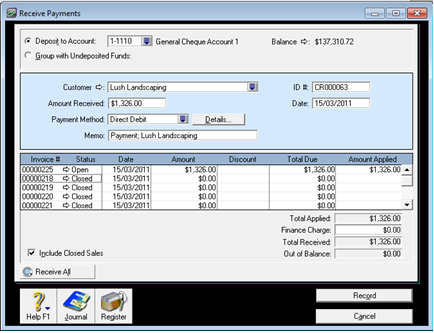

Final Payment is received- In MYOB, open the Sales module and click on ‘Receive Payment’. Select the client from the drop-down list and click on the Use Customer button. A pop-up window appears (see below) click on Apply Credits, if there is only one outstanding invoice in MYOB, if more than one, click on Open Register and select the invoice from the Sales Register.

Another message appears, click on OK.

Enter the balance payment as normal and click on the Record button.

Last Revised: 29/03/2012 SJ